It’s easy to be a trendy innovative company when it’s a bull market and money is being thrown left, right, and center…

But when things slow down and money isn’t moving as fast? Cracks tend to appear.

We’ve seen it a couple of times now with different cryptocurrency exchanges… from MtGox to FTX and beyond…

These centralized exchanges have disappeared for different reasons leaving users high and dry, without funds they thought were “decentralized” and “secure from authority” — despite the fact it had a single point of failure.

Voyager, one of these centralized exchanges, declared chapter 11 bankruptcy on July 5. 2022.

Since Then, Withdrawals Have Been Paused With Funds Locked in the Exchange

Gears have been moving in terms of court filings… but that doesn’t matter.

What matters is customers being able to withdraw the funds they’re rightfully owed, which is one of the cons of centralizing your crypto at any specific exchange.

At that point you have the cons of regular fiat without the benefits of it, like government insurance for situations just like this.

You might as well use a decentralized exchange, and keep all of the funds in a user owned wallet:

Like crypto was meant to be used.

I digress…

Since users didn’t have any access to withdraw funds, all they could do is sit and wait on this court filings to hopefully shake out.

Voyager was almost sold twice during bankruptcy, first to cryptocurrency exchange FTX.

Voyager said the bid from FTX US was made up of the fair market value of its crypto holdings as of a to-be-determined date, which as of Sept. 26 is estimated at $1.3 billion, as well as additional consideration of at least $111 million.

(That same mentioned exchange FTX is suing Voyager right now, which is relevant below…)

It was a $1.4 billion dollar deal that would have resulted in 72% of customers funds being recovered, which was extremely close to happening.

That was until, well… Sam Bankman-Friend allegedly dipped out of the cookie jar and FTX ran out of magic money that kept printing.

FTX imploded right after Voyager, right around the time the market started shifting to a bear sentiment (which it’s still basically at right now).

(Bitcoin’s decline since 2022 per Google, right about the time of many of these exchanges closing down.)

It’s safe to say the deal didn’t go through.

The second time Voyager almost got sold was to Binance.us.

That’s the United States regulated arm of essentially the biggest global exchange, Binance.

https://t.co/AZwoBOgsqS has made the difficult decision to exercise its right to terminate the asset purchase agreement with Voyager.

While our hope throughout this process was to help Voyager's customers access their crypto in kind, the hostile and uncertain regulatory climate…

— Binance.US 🇺🇸 (@BinanceUS) April 25, 2023

But like FTX, they backed out (unlike the bankruptcy).

Nearly a Year Passes Since Declaring Bankruptcy

A whole lot of nothin’ has happened.

A couple deals almost sort of went through. But they didn’t, so it doesn’t matter.

Things were looking bleak for Voyager users. That is… until recently.

You see:

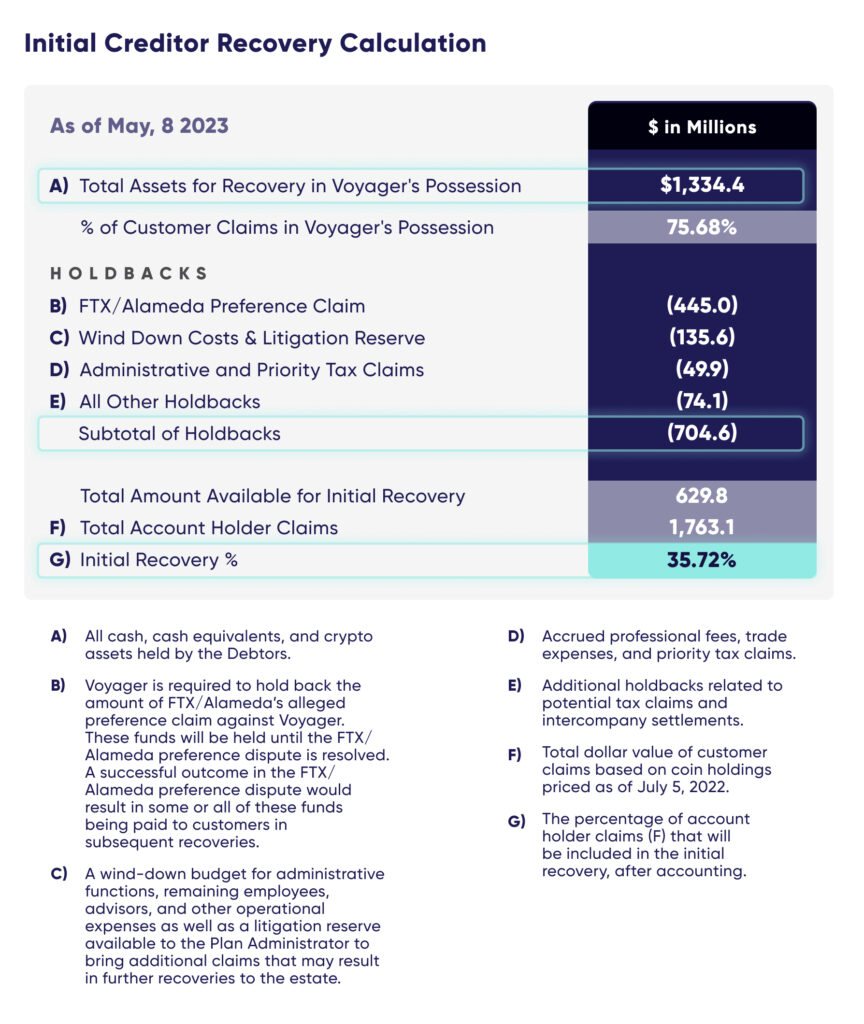

Right now Voyager has access to about $1.8 billion dollars of funds.

However, FTX is actively suing them for about $445 million of it.

Which, of course, is relevant to the FTX users being able to recover their own funds. There’s going to be a loser on one side of that situation.

Essentially, that’s the definition of robbing Peter to pay Paul.

So… Voyager has to save a bit of that $1.8 billion dollars just in case for FTX.

That Leaves Them With a Remaining $1.33 Billion Dollars To Give Back to Their Previous Users

All they needed is the judge to finally sign off on their bankruptcy procedure, and they could finally start to move forward instead of bothering with another failed acquisition.

And well… third time is indeed the charm for Voyager, because this attempt went through.

As of May 17, 2023 (nearly a year since declaring bankruptcy in July, 2022) the judge in charge of the Voyager case has officially approved of their bankruptcy plan.

That results in about 36% of user funds being returned, starting very, very soon.

https://twitter.com/VoyagerUCC/status/1658942961172791298

Some had their complaints…

Why are lawyers & executives for #Voyager not forfeiting their pay if they didn't do their jobs, especially when many are working other #crypto bankruptcy cases? 🤔

In what other industry can you fail at literally everything & still come out with millions?

Make it make sense. https://t.co/BQEu0J9h9H

— hero✖community (@heroXcommunity) May 15, 2023

Warranted, no doubt.

But probably the biggest complaint is the fact that users still aren’t getting paid:

It’s now been 1 week since the initial distributions were to be made.

Creditors are hurting, DO YOUR JOB!

You agreed for the plan to go effective! https://t.co/yF1LgqaJiP

— EthDaddy 🏴☠️ (@ETHjuiced) June 8, 2023

I’m surprised people still believe time tables given by anyone or anything regarding @investvoyager . What a continual 💩show for a year now.

I get it, people with voyager can say it’s out of their hands. I don’t really care. You’re all involved in who does what, everyone…

— DJ Crypto (@DJCryptoYT) June 20, 2023

(If you’d like to see a conga line of complaints about Voyager withdrawals, just search @investvoyager on Twitter. Promise you’ll find one.)

It’s To Be Determined if Voyager Follows Through on It’s Promises, but…

Things are still looking bright for Voyager users.

This bankruptcy procedure was just approved, customers are definitely understandably jaded but one month isn’t a very long time.

Especially when you’ve already been waiting nearly a year.

Basically, what I’m saying here is:

While their goal might have been June 1st originally… slow progress is better than no progress.

They have some of the funds, which is better than none of the funds to give back to their customers.

Plus, they’ve officially gotten their okay from the government – they just need to make it happen, and they might even be able to return more funds pending how legal situations shake out.

Only time will tell how this all plays out, especially for FTX (you’ll see an article on them and Sam coming soon too, promise)… but at least hopefully we’ll see previous clients being able to get back some of their funds here soon.

Maybe this is all just one giant lesson.

Like, you know…

Decentralized wallets are nice.

Leave a Reply