Microsoft Hits an All Time High: Will the 20-Year Dog Now Be a 20-Year Bull?

Nov 10, 2023 @ 1:00 pm

/

/

Microsoft (NASDAQ: MSFT) hit an all-time this week, cresting over $368 per share, which values the company at nearly $2.7 trillion.

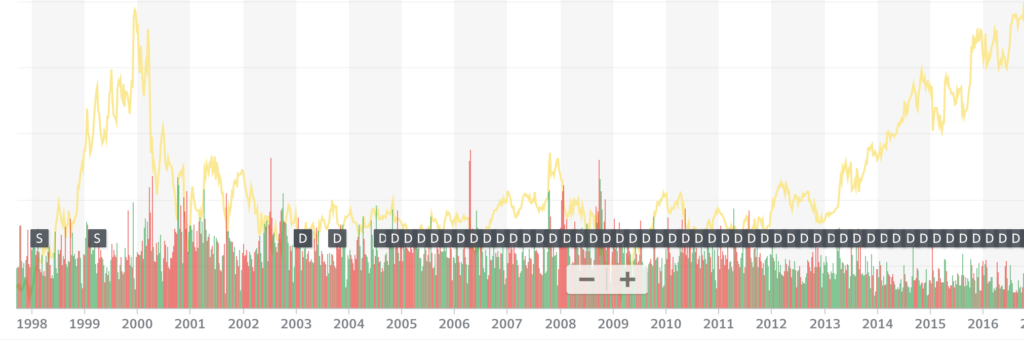

For nearly two decades, MSFT was a terrible investment:

If you bought at the peak of the dot-com bubble in December 1999, you weren’t break-even on your investment until 2017! And if you consider the opportunity cost, that stat is even more painful.

If you bought a little after, you just sat there treading water year after year. There were small peaks and valleys but MSFT was certainly not a growth stock.

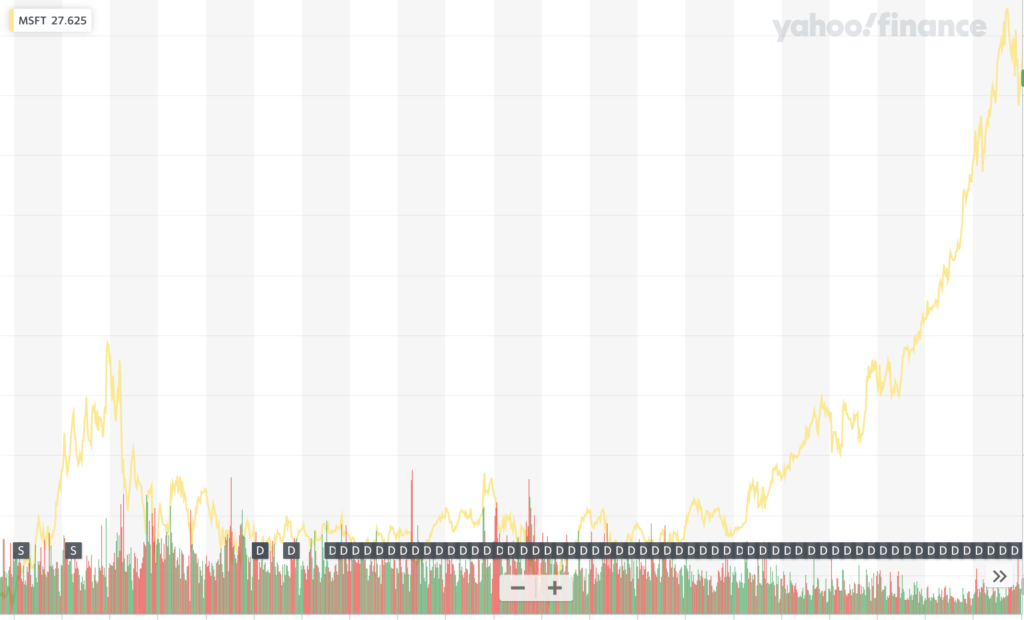

Now here’s the rest of the chart:

Since 2017 the stock has been on a tear, up 6x since then. People like Bill Gates and Steve. Ballmer have gotten stratospherically rich, and so has your typical teacher’s pension fund and 401K holder.

The driver of all of this has been Azure. Microsoft has continued to sell all its other products of course, and gotten into hardware as well, but the cash cow is Azure. They have a natural on-ramp for all their enterprise clients, plus whatever other deals they can sell and the general public. Azure is now over a third of Microsoft’s revenue.

What do you think about the future of this behemoth?

Raindog308 is a longtime LowEndTalk community administrator, technical writer, and self-described techno polymath. With deep roots in the *nix world, he has a passion for systems both modern and vintage, ranging from Unix, Perl, Python, and Golang to shell scripting and mainframe-era operating systems like MVS. He’s equally comfortable with relational database systems, having spent years working with Oracle, PostgreSQL, and MySQL.

As an avid user of LowEndBox providers, Raindog runs an empire of LEBs, from tiny boxes for VPNs, to mid-sized instances for application hosting, and heavyweight servers for data storage and complex databases. He brings both technical rigor and real-world experience to every piece he writes.

Beyond the command line, Raindog is a lover of German Shepherds, high-quality knives, target shooting, theology, tabletop RPGs, and hiking in deep, quiet forests.

His goal with every article is to help users, from beginners to seasoned sysadmins, get more value, performance, and enjoyment out of their infrastructure.

You can find him daily in the forums at LowEndTalk under the handle @raindog308.

Leave a Reply