I’ve been a Dropbox subscriber for a loooong time – since 2008. Long enough to remember when you got 2GB for free and if you could get another friend to try it, you’d get another 2GB. I think I harassed enough relatives to get my account up to 20GB, and when that filled up, I finally ponied up with a monthly sub. Heck, I’ve used them so long that I remember briefly flirting with SugarSync, SpiderOak, and other minor competitors who’ve come and gone (or are they still around? I’ve never needed to look).

I’ve been a Dropbox subscriber for a loooong time – since 2008. Long enough to remember when you got 2GB for free and if you could get another friend to try it, you’d get another 2GB. I think I harassed enough relatives to get my account up to 20GB, and when that filled up, I finally ponied up with a monthly sub. Heck, I’ve used them so long that I remember briefly flirting with SugarSync, SpiderOak, and other minor competitors who’ve come and gone (or are they still around? I’ve never needed to look).

While many companies tout that their solutions “just work,” Dropbox for me has been a service where that is actually true. From macOS to Windows to headless command-line Linux, Dropbox has been flawless for years. Their core product – synchronizing a folder on every device you want – “just works” and has the right mix of features (selective sync, LAN sync, some cli reporting and management features, etc.)

But For How Much Longer?

While technically Dropbox is excellent, technical excellence is only table stakes in the marketplace. How much longer can Dropbox, Inc. continue as a standalone enterprise?

Let’s look at Dropbox’s numbers, and then consider their competitive position.

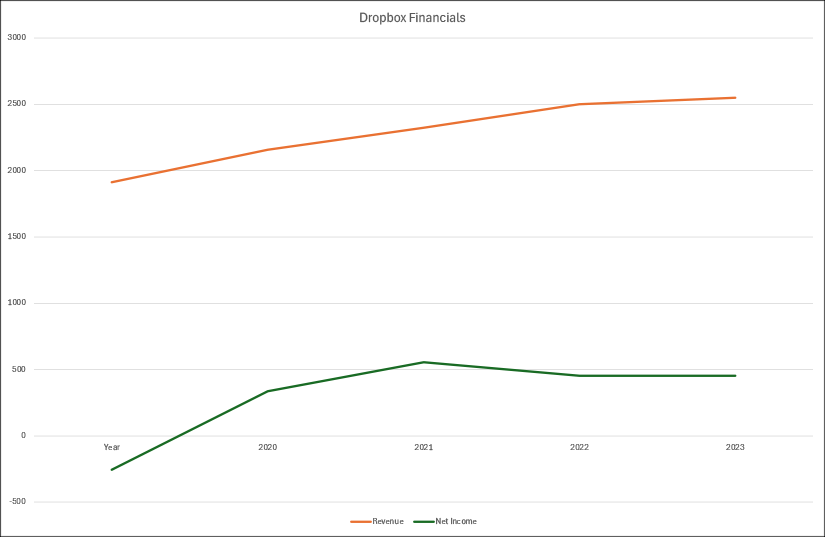

First, a couple charts. Here’s DBX’s revenue and net income over the last 5 years:

Now that’s not bad, in the abstract. They take in $2.5 billion and throw off $500 million. If that was my private enterprise, I’d be delighted.

But this is a tech company, and one that sports a tech multiple (P/E) of 18. What tech investors want to see is a lot steeper angle of attack – if not a hockey stick graph – on revenue at least, and preferably income as well. Even if you didn’t know what company we were talking about, if I showed you this chart, you would not think that this company was on a course for breakaway growth. You’d think it was a mature enterprise with limited options for growth.

Or really no growth at all. They grew from $2 billion in revenue (2020) to $2.5 billion (2024 EOFY). That is a compounded annual growth rate of about 4.5%. Now let’s assume that some portion of that is subscriber growth, and the rest is increased revenue per subscriber – either by raising prices or by offering additional subscription services 0r higher tiers of service. What an investor would want to see is much more of the former – more adopters of the platform and Dropbox growing its market share.

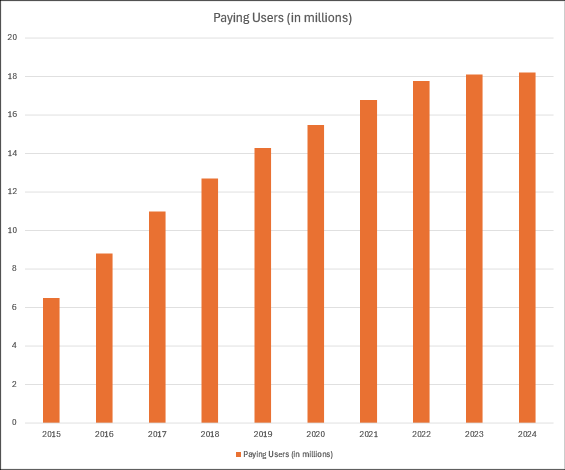

But that is not the case:

Ouch. For the last three years, the number of paying users has been flat.

The Challenges

Here are some challenges I see for Dropbox:

- Their core product was innovative when released in 2008, but is now a commodity offering.

- Their core product has two powerhouse competitors (Google Drive, Microsoft’s OneDrive) and many smaller ones. Even for less-featured competitors, such as Apple’s iCloud, that service is good enough for many users, which sucks market share away from Dropbox.

- In these situations, it’s often a race to the bottom and those with the biggest scale win.

- Switching to another product would be disappointing but honestly not that painful for most people, which is their core problem. There’s no lock-in. I love Dropbox but if I had to switch to Google Drive tomorrow, I wouldn’t really lose any functionality.

- Other competitors (Google, Microsoft) offer their core service as an adjunct, while for Dropbox, it’s their bread-and-butter.

They’ve attempted to diversify into other offerings but when I think “Dropbox” I don’t think “collaborating on documents” or anything else they do.

Quo Vadis, DBX?

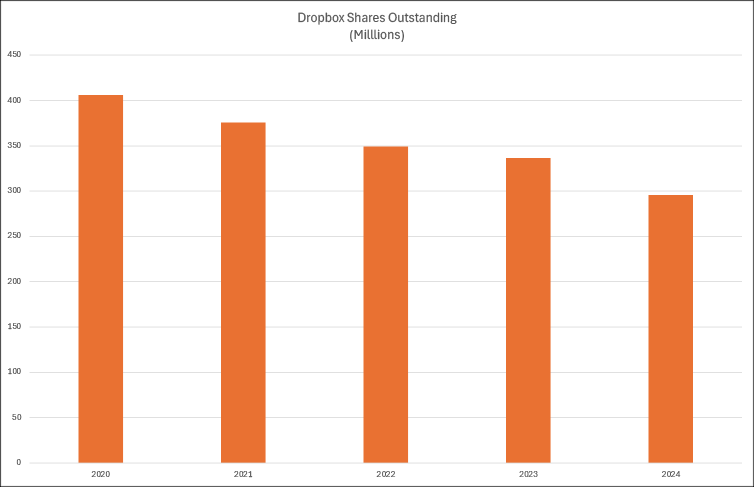

Here is one chart that would seem to cheer DBX share holders:

Management has been repurchasing shares through buybacks – almost $4 billion worth since 2020. So if you bought shares in 2020, today you’d own a bigger percentage of the company than you did then. What’s not to like?

In the abstract, nothing. But in the bigger picture, that says a lot about Dropbox.

In a tech growth enterprise, cash from operations is poured into either growing the business through R&D or through acquisitions. Dropbox has certainly spent some on acquisitions:

- HelloSign, an e-signature DocuSign competitor, $230m in 2019

- DocSend, a similar company, $165m in 2021

- FormSwift, yet another similar company, $95m in 2022

- Reclaim.ai, a calendar app, $40m in 2024

And the company has spent $700-900m a year on R&D since 2020. Keep in mind that R&D is not purely “wizards in the lab” but virtually everything that could remotely be called development – supporting new operating system versions, adjusting for the latest iOS or Android changes, internal database changes, etc.

Both of these activities (acquisitions and R&D) have not added much rocket fuel, as shown by the revenue chart at the start of this article.

If a company can’t find a way to grow by investing in itself, it returns money to investors – either through dividends, or share buybacks (which are a tax-advantaged form of dividends). Once dividends/buybacks start, a company is essentially saying that the market is tapped out.

Buybacks are the Kiss of Death for Tech Growth

Consider a fictional hotdog chain called RainDogs. They start in my hometown of Grand Rapids, Michigan, and for the first decade or two, new RainDogs stands are opening up all over the country. Once the USA is filled up, they go international, first into Canada and Mexico, then into Europe, and pretty soon you’re seeing Instagrams of influencers ordering the signature chili cheese and mustard dog in Tokyo, Singapore, and Lagos.

Eventually, however, the world has enough RainDogs restaurants. At that point, the company can’t find profitable locations for new sites, and cash begins to accumulate. The existing restaurants are doing fine, and every now and then there’ll be a boost in revenue from some new promotion or perhaps some famous celebrity signs up as a sponsor. But once growth is tapped out, RainDogs, Inc. can’t sit on its growing cash hoard forever. At that point, it’ll start issuing dividends or begin buying back its shares.

In the real world, it’s somewhat more nuanced of course, but that’s the basic business theory.

So what Dropbox is saying with its buybacks – which started in 2020 – is that its market is tapped out. Its attempts to diversify into document signing, group collaboration, etc. have not resulted in the kind of additive subscriber growth that its tech multiple demands.

Predictions

What I think will happen is that Dropbox’s multiple will drop as investors realize that paying 18 years’ anticipated earnings is not a good use of their money. That will cause the price per share to drop. As of this writing, Dropbox has a market cap of $7.5 billion and is trading at about $25 per share. What if that multiple drops a little – say, to 15? Still pretty rich. That would take Dropbox down to $6.1 billion in market cap.

If Dropbox runs into financial trouble – and in December 2024 they borrowed $2 billion in new, 5-year debt to fund a $1.2 billion share repurchase plan – then that multiple could go down further. Borrowing money to buy shares back is the kind of financial gimmickry that companies engage in when they have no other way to prop up their share price. It’s a flashing red light.

If Dropbox’s market cap declines – or even if it doesn’t – would they be a candidate for acquisition? The lower outstanding share count has both a positive and negative effect for acquirers. Insiders would own a bigger piece of the pie and there’s less stock available for purchase, but on the other hand, the effect of declining financials on market cap is magnified.

Ultimately, I think Dropbox will likely be acquired because they’ll struggle to survive as standalone enterprise. They’re already resorting to borrowing money to hand out to shareholders, and growth is flat. Even if they can service the debt, it’s hardly an inspiring business plan for a tech company.

If they are acquired, it’ll probably be pretty savage. It’s hard to imagine that Google or Microsoft would fork out very much for 18 million subscribers when their subscriber counts are measured in the hundreds of millions. That leaves private equity, who would likely come in like Elon Musk with a chainsaw.

I’m not a Dropbox investor, just a long-time subscriber who will miss them when they’re gone.

These days, I’m not sure why someone would pay for Dropbox when a family plan for Office 365 is a similar price but also includes email and all the Microsoft Office apps for up to six people.

In my case, lethargy. O365 has very little attraction to me, other than family members want the desktop apps so we subscribe.

I think that Dropbox should release an E-mail service!